Regulatory Challenges in the African Finance Sector and its Impact on FINTECH

Africa’s finance sector is witnessing rapid innovation and technological advancements, with fintech startups at the forefront of this transformation. However, these startups often face significant regulatory challenges that hinder their growth. In this article, we will explore the regulatory landscape of the African finance sector, examining its impact on fintech firms through case studies from four African countries. Additionally, we will highlight key fintech trends to watch out for in Africa, emphasizing the importance of staying updated in this evolving landscape.

Regulatory Challenges and Case Studies:

Fintech firms in Africa often encounter various regulatory hurdles that impede their progress. Let’s delve into these challenges through the lens of a few case studies:

- Licensing and Compliance: Complex licensing procedures and stringent compliance requirements deter many fintech startups from entering the market or force them to operate in a legal grey area. Kenya’s M-Pesa initially faced regulatory obstacles, but the Central Bank of Kenya recognized the need for tailored regulations for mobile money services.

- Unclear Regulatory Frameworks: Evolving and ambiguous regulatory frameworks can create uncertainty for fintech firms. Nigeria experienced disruptions in its cryptocurrency industry due to the Central Bank of Nigeria’s restrictions in 2021, hindering innovation and growth in the financial services sector

- Financial Inclusion Barriers: Stringent identification requirements and lack of interoperability with traditional banking systems limit the reach of fintech firms aiming to address financial exclusion. In South Africa, concerns about data privacy and security have delayed the implementation of comprehensive open banking frameworks, affecting companies leveraging this innovation.

- Cross-Border Regulatory Challenges: Fintech’s aiming to expand beyond their home countries face obstacles such as licensing hurdles, foreign exchange restrictions, and data protection laws. Ghanaian startups in mobile banking have faced challenges related to anti-money laundering regulations and Know Your Customer (KYC) requirements.

Get the exclusive report “Fintech Trends to Watch For in Africa.” here

Fintech Trends to Watch For:

Despite regulatory challenges, the African fintech landscape offers significant opportunities for the financial services sector. Key fintech trends to watch out for in Africa include:

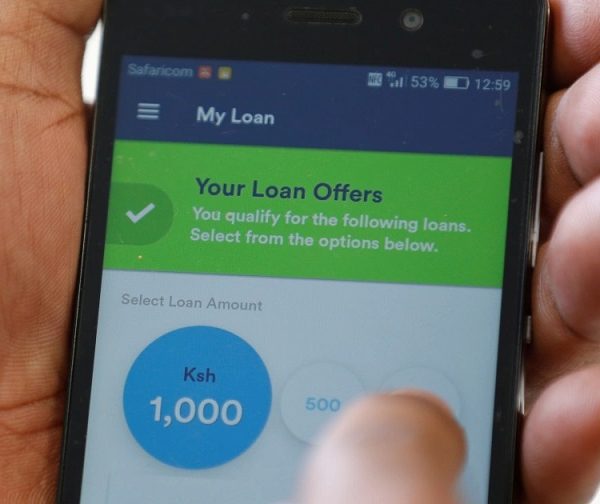

- Digital Lending: Mobile money and digital payments have facilitated innovative lending solutions like peer-to-peer lending and microloans. Fintech firms using alternative credit scoring methods and blockchain technology are well-positioned to meet the demand for accessible credit.

- Insurtech: Fintech firms are leveraging digital technologies to provide tailored and affordable insurance products, increasing financial inclusion. Microinsurance and usage-based policies are reshaping the insurance sector in Africa.

- Blockchain and Cryptocurrencies: Firms exploring blockchain technology and cryptocurrencies can revolutionize finance across Africa. From cross-border transactions to decentralized financial services, these innovations have transformative potential, but regulatory clarity is essential.

- Regtech: Regulatory technology (Regtech) solutions help fintech’s streamline compliance processes using automation, artificial intelligence, and data analytics. This improves risk management and ensures compliance with evolving regulations.

The way forward?

Regulatory challenges pose hurdles for many fintech firms in Africa, impacting licensing, compliance, financial inclusion, and cross-border operations. However, by understanding these challenges and leveraging emerging fintech trends, entrepreneurs, and stakeholders can unlock the continent’s potential.

To stay ahead, we invite you to download our FREE report on “Fintech Trends to Watch For in Africa.” Gain valuable insights and strategies to thrive in this dynamic ecosystem, unlocking the vast potential of the African fintech sector.

Download your FREE report here

By addressing regulatory challenges, fostering collaboration between regulators and the financial services sector, and staying informed about emerging trends, we can collectively drive financial inclusion, economic growth, and technological innovation across the African continent.

Ready to invent the future?

Our teams possess extensive in-market experience that drives measurable growth for brands. Please reach out to us to learn more.